There has been much noise this past week about Avaya (NYSE:AV) being acquired by Nortel (NYSE, TSE: NT). Wall Street Journal (May 21, 2007 – Avaya: Merrill’s perfect LBO candidate , May 29, 2007 – Avaya may be next telecom takeover target) various industry blogs including Om Malik. I tried to resist commenting, but couldn’t. Here’s my take on the program and the prospects for a united Nor-ya.

There has been much noise this past week about Avaya (NYSE:AV) being acquired by Nortel (NYSE, TSE: NT). Wall Street Journal (May 21, 2007 – Avaya: Merrill’s perfect LBO candidate , May 29, 2007 – Avaya may be next telecom takeover target) various industry blogs including Om Malik. I tried to resist commenting, but couldn’t. Here’s my take on the program and the prospects for a united Nor-ya.

Introducing the parties:

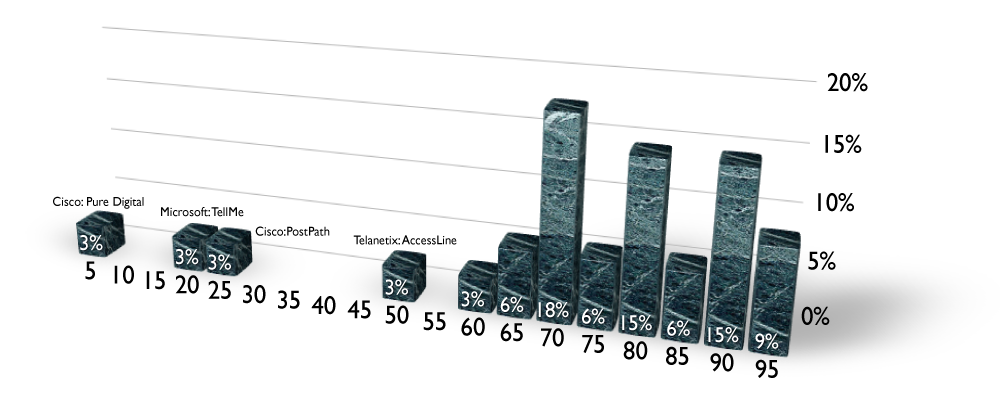

Avaya is a leading (one of the top 3 with share over 20% depending on who you believe) profitable player in enterprise telephony markets. They have extensive direct sales relationships with the largest organizations in America and are a leader in messaging systems, call center systems, and through recent acquisitions in Europe communications professional services. Avaya sees service provider as a growth market, having introduced hosted products and acquiring Ubiquity, an IMS Application Server company. As part of their spinout from Lucent in 2000, Avaya agreed to a mutual non-compete for five years.

Nortel is a leading player in enterprise telephony (also one of the top 3), but has complementary channel relationships with the biggest equipment resellers in America (many of whom are also Cisco resellers, the 3rd major player in enterprise telephony today). Most significant is Nortel’s service provider play in wireless carriers, IMS services and optical networking. Three-quarters of the company’s revenues (although none of its growth prospects) come from the service provider market.

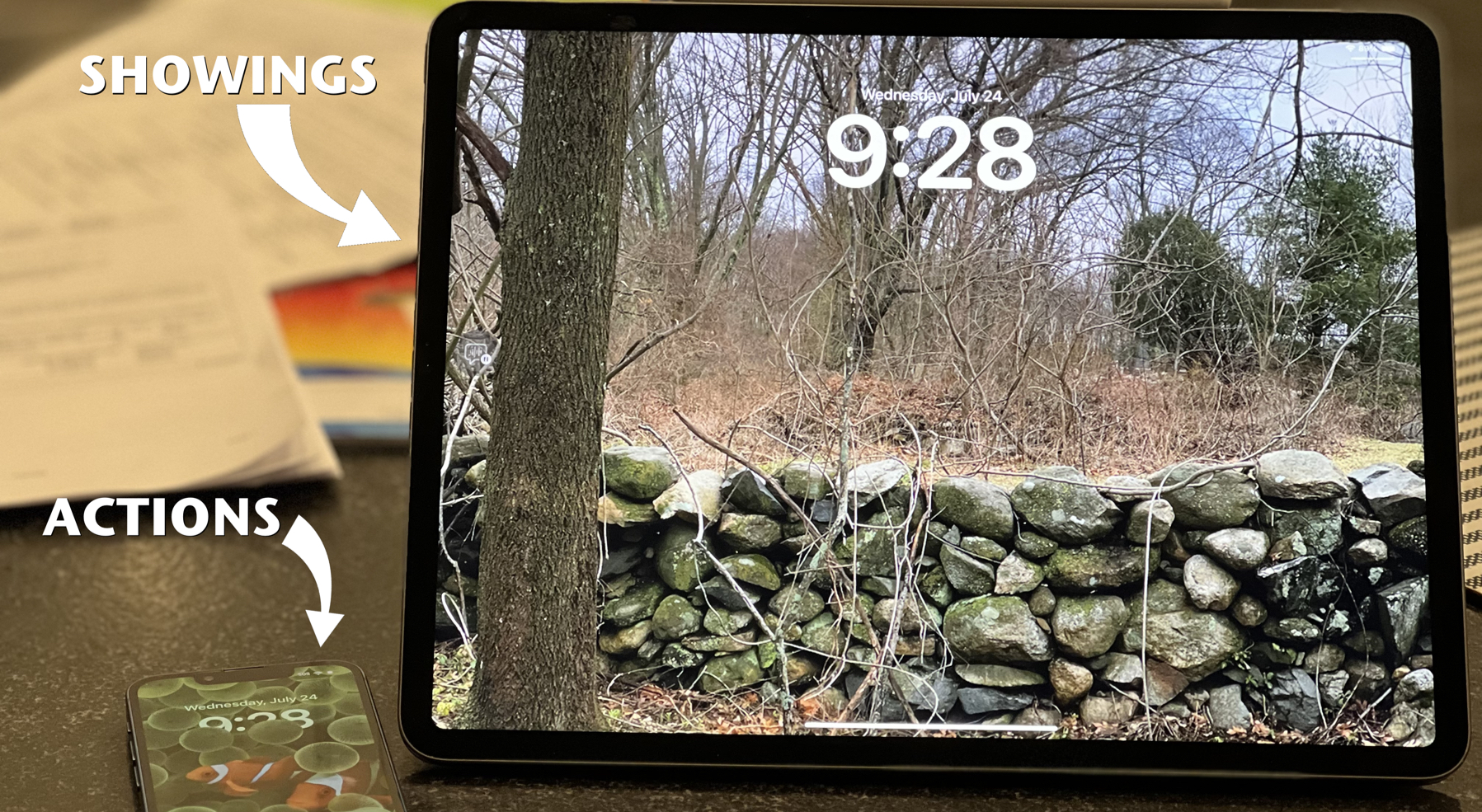

Here’s the classic Brockmann perspectives. SCORE: 17/20 = 85%, B.

Strategic Fit [5/5].

Complementary channel. Some overlap in products, but certainly sustainable R&D and committed customers.

Timing [5/5].

With the emphasis on ‘unified communications’ coming through the marketplace and the determined posturing of Microsoft (the company doesn’t give up lightly on any market), consolidation of telephony players is already underway. So the securities market expects deals to happen. See Tale of Two Tels.

Customer Demand [3/5].

There are many, many accounts with both Avaya and Nortel systems (and Cisco for that matter) in place. Many purposefully chose to form a kind of creative tension in the architecture of the enterprise communications services. I would advise Nortel NOT to use the prospect of customer platform consolidation as any basis for the decision. I remember when Nortel bought Bay Networks, and when we told our customers and resellers that they could get data products from us too, they said, ‘we would have bought Bay Networks products if we wanted them. Changing the logo isn’t helpful to us.’

Potential [4/5].

The enterprise communications market is growing (finally and thank God!). Execution, of course will be key to any successful integration. Although, this deal, if it happens, could easily be an Oracle-like transaction – multiple businesses under one roof since acquiring competitors is cheaper than acquiring customers. I’d expect this deal to be much like that – independent channels, competitive products, multiple brands. Make the Nortel brands tuned for channel resale, Avaya for direct sales.

Risks.

Ego. I saw both Lou D’Ambrosio (CEO of Avaya) and Mike Zafirovski’s presentations. One of these is really enterprise customer centric, while the other is probably best as the leader of a holding company. Can you guess which one is which? (see the registered story). Can these two get along in a way that makes a deal work and creates value AFTER the deal?

Synergies.

R&D Savings. Avaya just introduced a SIP-based distributed telephony server (just like the MCS 5100/5200). Kill it. Phones. Avaya makes their own phones, Nortel sources their phones from Aastra. Sell this business.

Services. Avaya should lead this initiative. Sure, break-fix is a big part of the legacy, but this could be packaged and sold to Nortel resellers who are service specialists.

Branding. What if all Nortel enterprise products were branded Avaya? Leaving the carrier offering and the parent company named Nortel. This could give the holding company a multi-branding strategy that would stop the silly over-simplification of the branding for service providers compared to branding for enterprise. Hopefully, this would mean big investments in marketing to this segment. Hyperconnectivity (yuck) anyone?

Sales Management. Surely, integrating overlapping channel programs and consolidating account management for Nortel & Avaya customers offers some savings, but not alot. Both companies have pretty efficient channel management techniques (web portal, MDF automation) and substantially uniform products in telephony. Data products remain the Nortel side’s biggest differentiator. This deal will have consequences for Extreme Networks and others who had some kind of joint marketing and sales alliance with Avaya, but have data products that overlap with Nortel.

Final note – Speculation is fun and fraught with risks. Big deals have big risks – digesting takes time and big $. This is not a solicitation for stock. Brockmann & Company may own shares of one or both of these companies.

Recent blog entries about Avaya: Avaya acquires Traverse, Avaya Takes Out P2P Pioneer

Recent blog entries about Nortel: Zafirovski in WSJ, Speculation – Nortel buys Siemens Enterprise, Micro-Tel?

Well, according to the Wall Street Journal, Avaya’s accepted a $8 billion deal to go private. 🙁