Part of a multipart series on Busting Investment Myths

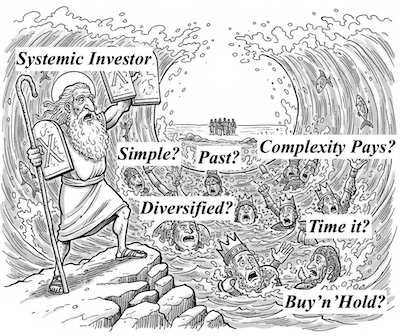

Diversification has become investment orthodoxy. “Don’t put all your eggs in one basket” gets repeated so frequently that most investors never question its limitations.

Diversification reduces certain types of risk, but it also reduces returns and creates new problems that traditional advice ignores.

What Diversification Actually Does

Diversification eliminates company-specific risk—the risk that individual stocks will decline due to problems unique to those companies. If you own 500 stocks instead of 5, no single company failure can devastate your portfolio.

But diversification cannot eliminate systematic risk—the risk that affects all stocks simultaneously. During market crashes, diversified portfolios still decline significantly because correlations between different assets approach 1.0 during crisis periods.

The Hidden Costs of Over-Diversification

Diluted performance. Owning hundreds of stocks ensures you’ll capture both the best and worst performers. Your winners get diluted by your losers, producing mediocre overall results.

Increased complexity. Managing diverse holdings across multiple asset classes, geographies, and sectors requires extensive research and monitoring. Most investors can’t effectively analyze hundreds of positions.

False security. Diversified investors often assume they’re protected from significant losses. The 2008 financial crisis proved this assumption wrong when nearly all asset classes declined simultaneously.

The Concentration Alternative

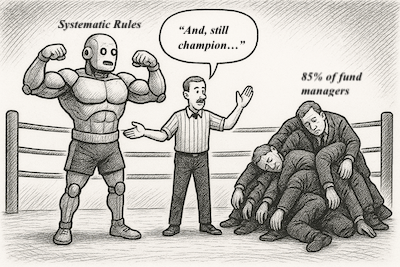

Some of history’s most successful investors have concentrated their holdings in their best ideas rather than diversifying broadly. Warren Buffett, Charlie Munger, and Bill Ackman have built their reputations on focused portfolios of high-conviction positions.

Concentration requires deeper analysis but can produce superior returns when combined with systematic risk management.

Smart Concentration with Systematic Exit Rules

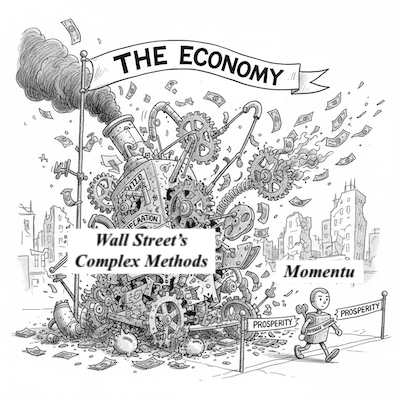

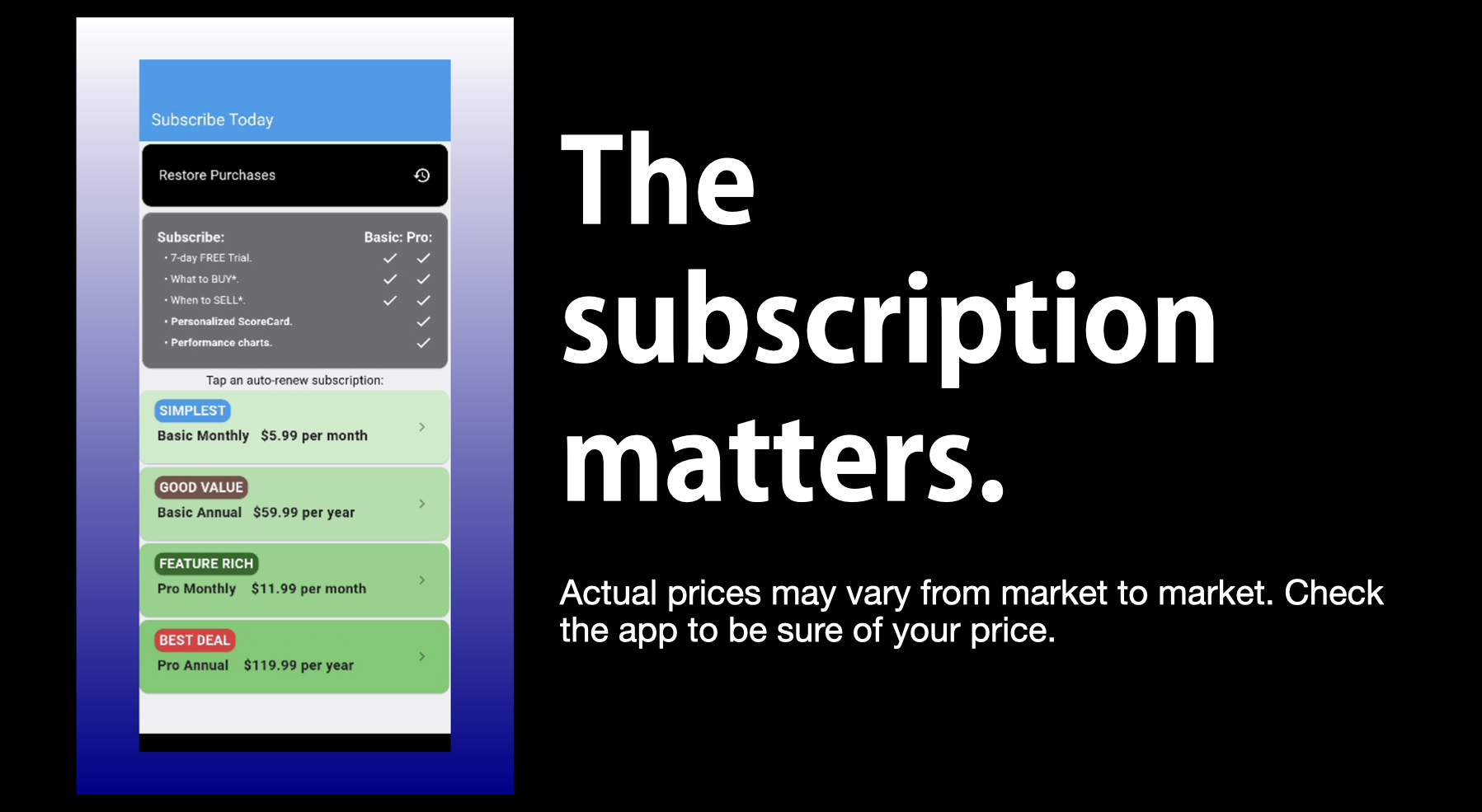

The Brockmann Method applies this principle by focusing on the S&P 100’s highest-ranked stocks rather than diversifying across all market segments. This concentration in quality momentum leaders has historically outperformed broad diversification.

The key innovation is combining concentration with systematic selling rules. Instead of holding declining positions forever (buy and hold) or trying to predict tops and bottoms (market timing), the system exits positions when momentum deteriorates.

Risk Management vs. Risk Elimination

Effective investing focuses on risk management rather than risk elimination. Some risk is necessary for generating returns above risk-free rates. The goal is taking calculated risks that are likely to be rewarded rather than spreading risk so broadly that potential rewards disappear.

Diversification serves as one tool in risk management, but treating it as the complete solution ignores both its limitations and better alternatives.

Tomorrow: Why past performance actually does have predictive value when used systematically.

Learn systematic risk management beyond traditional diversification. Read “The Future of Investing Is Here.”