Part of a multipart series on busting investment Myths

After six days of debunking conventional investment wisdom, what principles actually drive superior long-term returns?

The answer combines insights from decades of academic research with practical implementation experience.

What the Evidence Actually Shows

Momentum persists across time and markets. Securities exhibiting strong recent performance tend to continue outperforming for 3-12 months. This effect has been documented across different countries, time periods, and asset classes.

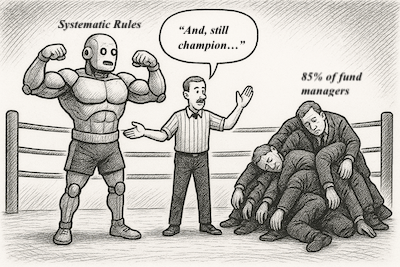

Systematic execution beats discretionary decisions. Rules-based approaches consistently outperform human judgment by eliminating emotional interference and behavioral biases from investment decisions.

Simple strategies are more robust than complex ones. Basic momentum and trend-following approaches often outperform sophisticated multi-factor models due to lower implementation costs and fewer failure points.

Concentration in high-conviction ideas outperforms broad diversification. Focused portfolios of systematically selected securities typically generate superior returns compared to broadly diversified holdings.

Selling rules matter as much as buying rules. Most investment strategies focus on security selection while ignoring exit criteria. Systematic approaches to both entry and exit decisions are essential for long-term outperformance.

The Practical Implementation Framework

Building on these principles, effective systematic investing requires:

Clear selection criteria: Objective, measurable standards for identifying attractive investments that can be applied consistently across all decisions.

Systematic ranking methodology: A process for comparing all potential investments and selecting the most attractive opportunities at any given time.

Disciplined execution: Following predetermined rules regardless of current market sentiment, recent performance, or external pressure to deviate.

Regular review and rebalancing: Periodic assessment of holdings against selection criteria with systematic adjustments when rankings change.

Cost management: Minimizing fees, taxes, and transaction costs that can erode gross performance over time.

The Brockmann Method Integration

Our approach incorporates all these evidence-based principles:

- Daily momentum ranking of S&P 100 securities

- Three-zone classification system for clear decision-making

- Systematic exit rules when securities lose relative strength

- Focus on 20-30 highest-ranked holdings rather than broad diversification

- Simple, cost-effective implementation through technology

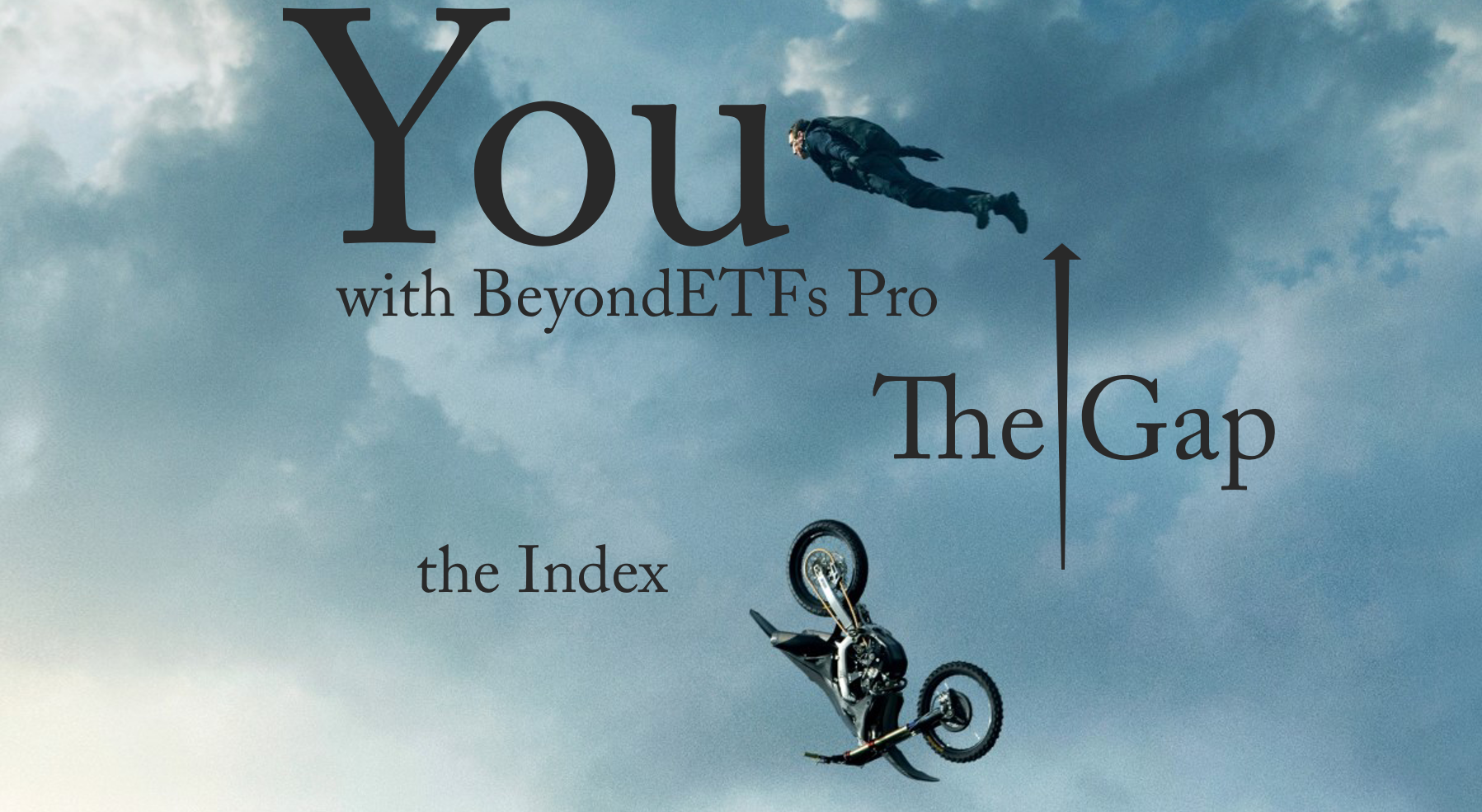

The 18-year backtest results validate this approach: $100,000 invested systematically would have grown to $2.5 million versus $500,000 for the index.

Beyond Investment Myths

The investment industry perpetuates myths that serve its interests rather than investor outcomes. Buy and hold generates steady fees regardless of performance. Complex strategies justify high costs. Professional management commands premium pricing.

Systematic approaches threaten this structure by delivering superior results at lower costs through simple, transparent methods.

The Path Forward

Successful investing doesn’t require predicting the future, timing markets perfectly, or understanding complex financial theories. It requires systematic application of proven principles with disciplined execution over long time periods.

The choice is clear: continue following conventional wisdom that serves industry interests, or adopt systematic approaches that serve investor outcomes.

Get the complete systematic investing framework. Read “The Future of Investing Is Here” by Wilfred Brockmann.

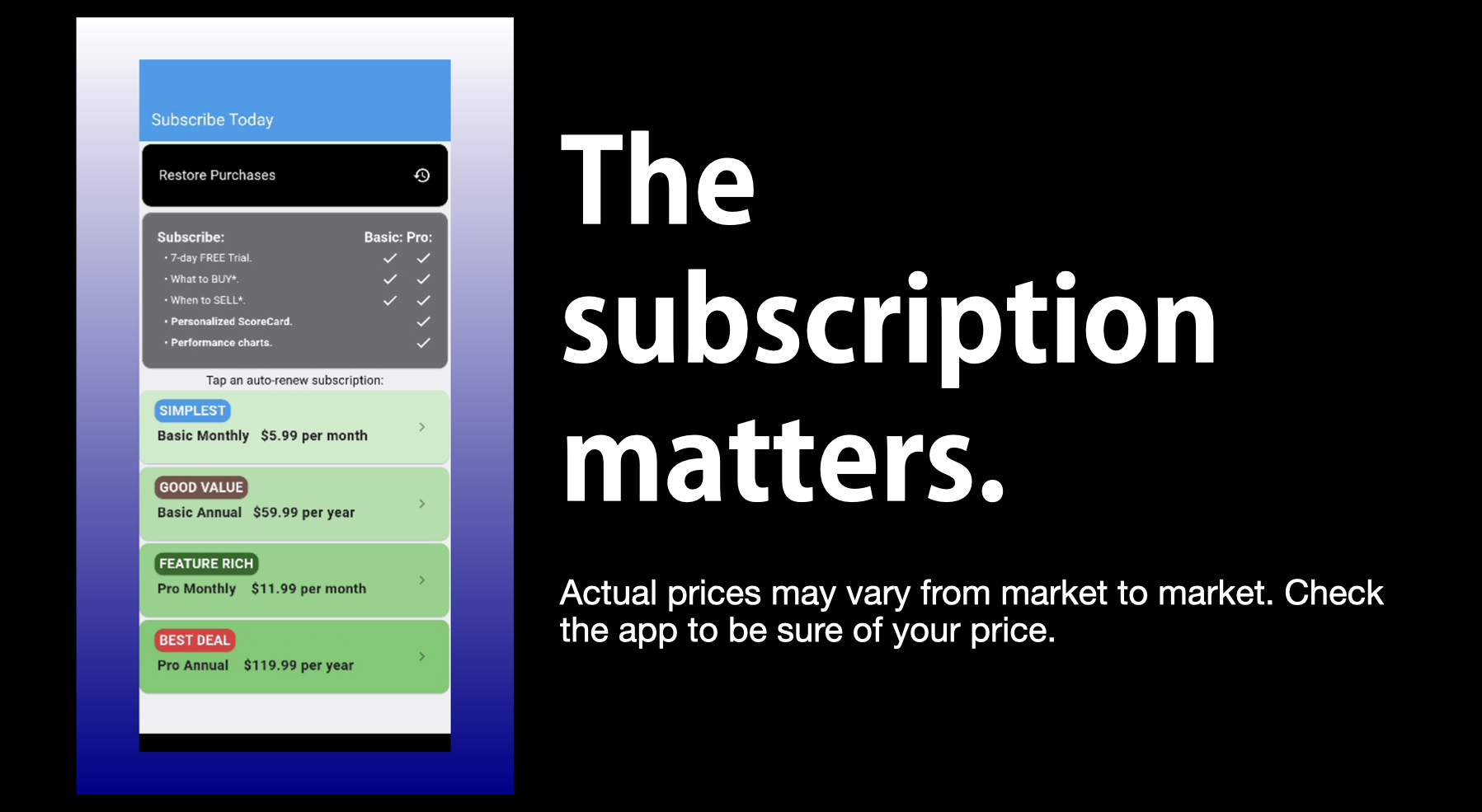

See the method in action with BeyondETFs Pro for iOS or Android.